Puma Alpha VCT

Open for investment

26%

NAV growth since inception (inc. dividends)

5p

Dividends paid to date

Overview

Puma Alpha VCT is our 14th VCT and was launched in 2020. It aims to deliver compelling returns through investments in companies that have graduated from ‘start-up’ to ‘scale-up’, while delivering the full range of tax reliefs that come with VCT investing.

Despite only launching in 2020, Puma Alpha VCT has already achieved a successful exit and generated a dividend payment of 5p per ordinary share.

Six key reasons to choose Puma Alpha VCT

We know that investing for long-term tax planning is essential to our clients, to help them achieve their financial goals. We believe Puma Alpha VCT offers clients six key benefits, to enable them to do this.

Tax benefits of a VCT

Investors can claim up to 30% income tax relief on VCT investments up to £200,000 per tax year, provided the VCT shares are held for at least five years.

Any gain made when VCT shares are sold is 100% free from capital gains tax.

Any dividends received from VCT shares are 100% tax-free, regardless of the investor's tax band.

Tax reliefs are not guaranteed, depend on individuals’ personal circumstances and a five-year minimum holding period, and may be subject to change.

LEARN MORE ABOUT VCTsExample portfolio investments

We aim to build on the track record of both the Puma VCTs and EIS services. As a series, together they have raised over £440 million and invested into over 65 qualifying companies and achieved over 35 full exits.

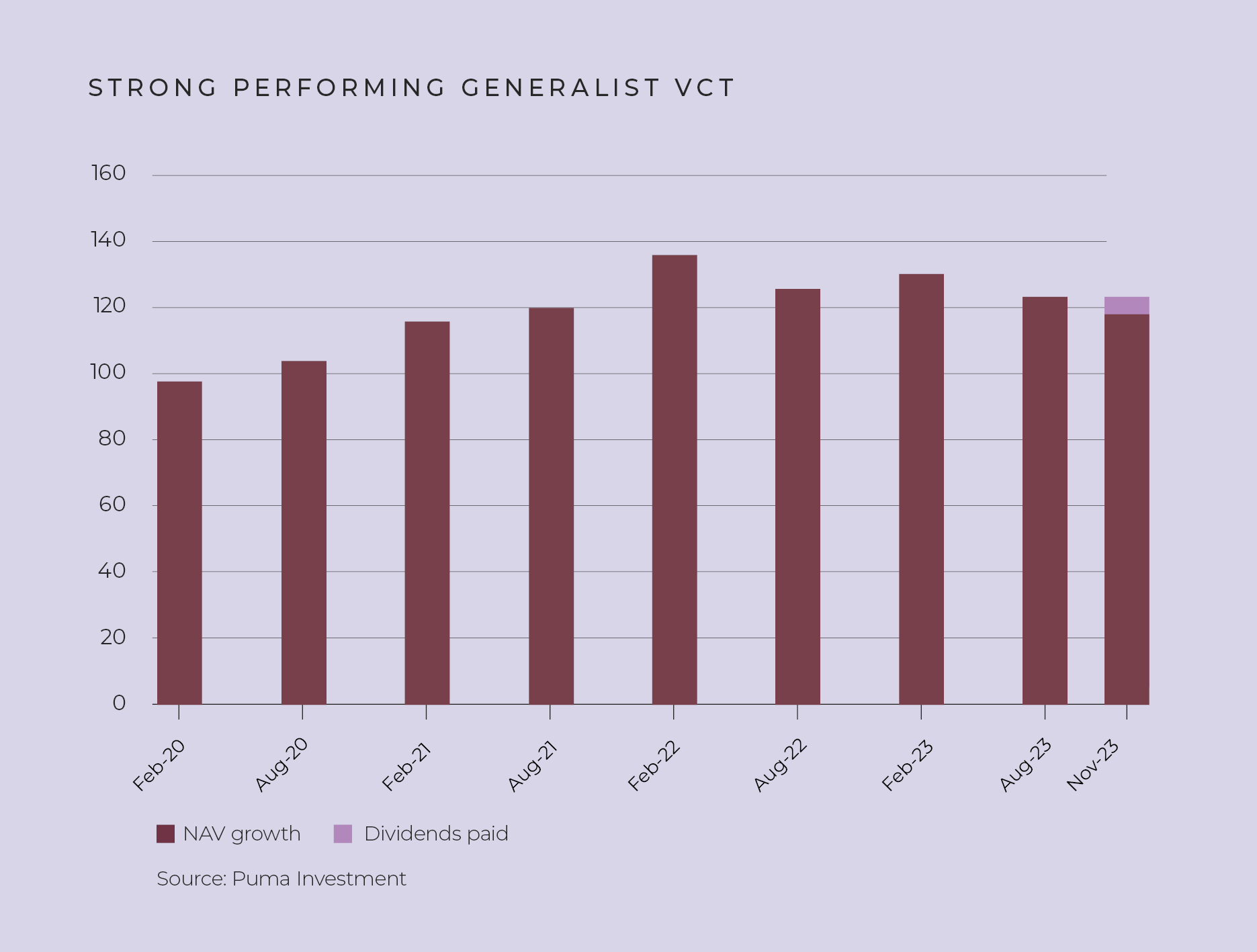

Strong track record

Puma Alpha VCT has shown strong performance since inception with a total return (NAV growth plus dividends) of 26% since inception.

Performance since inception

| YEAR | 2020 | 2021 | 2022 | 2023 |

| NAV | 104.35p | 120.86p | 126.13p | 118.50p |

| DIVIDENDS (PER ANNUM) | 0p | 0p | 0p | 5p |

| DIVIDENDS ( TOTAL) | 0p | 0p | 0p | 5p |

| NAV + TOTAL DIVIDENDS | 104.35p | 120.86p | 126.13p | 123.50p |

Source: Puma Investments

Puma Alpha VCT NAV and dividend data - 30 November to 30 November of the year shown. Past performance is not a guarantee of future results. Share prices and their values can go down as well as up. The payment of any dividends is not guaranteed, and any such payments may erode the capital value of any underlying investment.

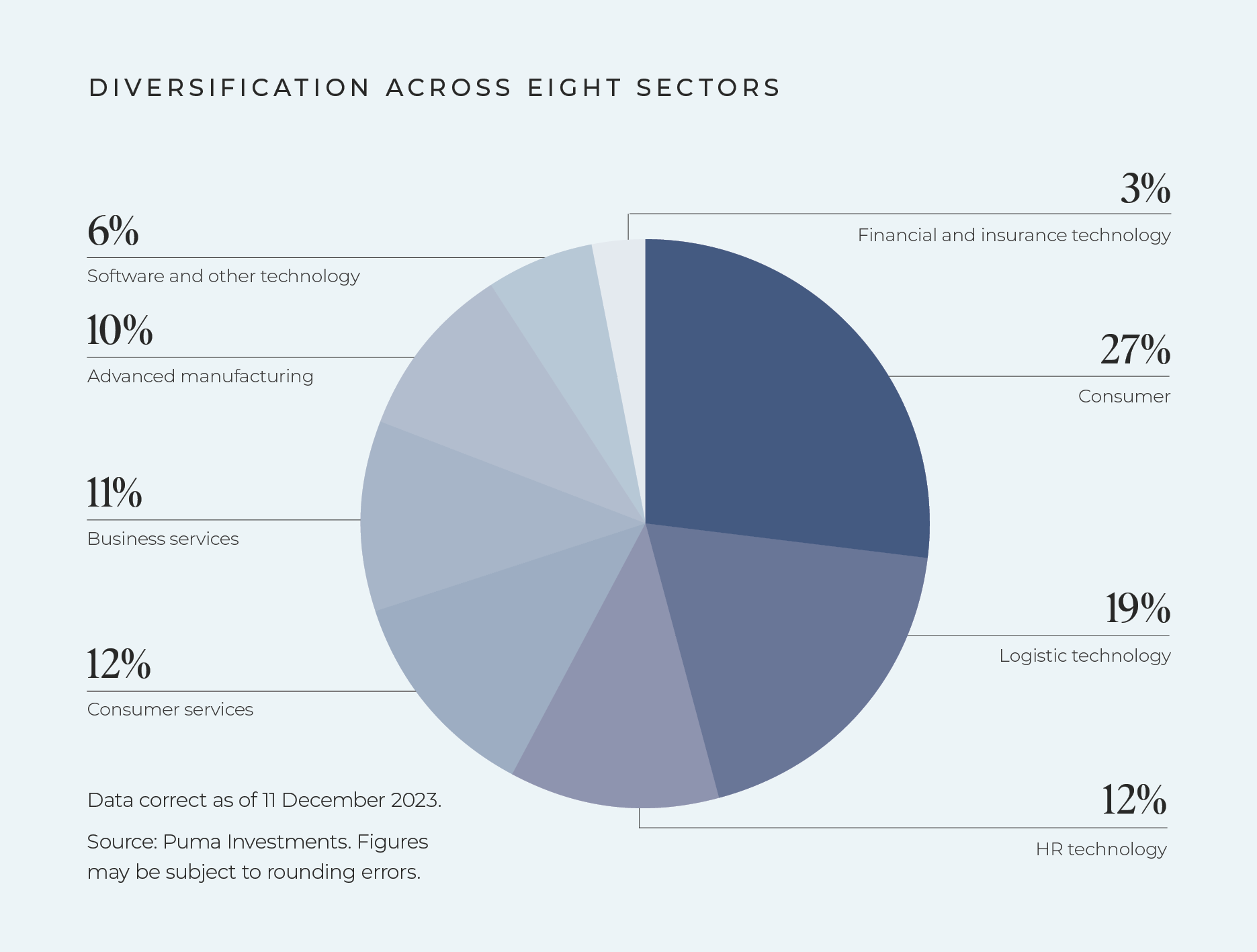

Portfolio diversification across eight sectors

AS AT 11 DECEMBER 2023

- 1Consumer

- 2Logistics technology

- 3Consumer services

- 4HR technology

- 5Business services

- 6Software and other technology

- 7Financial and insurance technology

- 8Advanced manufacturing

INITIAL FEE

3%

(PLUS VAT IF APPLICABLE) OF AMOUNT SUBSCRIBED

PERFORMANCE FEE

20%

(PLUS VAT IF APPLICABLE) OF THE INVESTMENT GAIN WITHIN THE PORTFOLIO (NET OF COSTS)

ANNUAL MANAGEMENT FEE

2%

(PLUS VAT IF APPLICABLE) OF NET ASSET VALUE PA

ADMIN FEE

0.35%

(PLUS VAT IF APPLICABLE) OF NET ASSET VALUE PA

GM and AGM results

See the results from Puma Alpha VCT's historical and most recent General and Annual General Meetings.

Dividend Reinvestment Scheme

The Scheme provides shareholders with the opportunity to reinvest their cash dividends into new shares in the VCT. New VCT shares attract the same tax reliefs as shares purchased through an offer for subscription.

Key risks

An investment in Puma Alpha VCT carries risk and investors should always take independent advice. Individuals should only invest in Puma Alpha VCT on the basis of the prospectus which details the risks of the investment. Below are the key risks:

Tax reliefs: Tax reliefs are not guaranteed, depend on individuals’ personal circumstances and a five-year minimum holding period, and may be subject to change.

Liquidity: It is unlikely there will be a liquid market in the ordinary shares of Puma Alpha VCT and it may prove difficult for investors to realise their investment immediately or in full.

Capital at risk: An investment in Puma Alpha VCT involves a high degree of risk. Investors’ capital may be at risk.

General: Past performance of Puma Investments in relation to its other VCTs is no indication of future results. The payment of dividends is not guaranteed. Investors have no direct right of action against Puma Investments. The Financial Ombudsman Service/the Financial Services Compensation Scheme are not available.

Figures on this page are taken from Puma Investments and are correct as of 30 November 2023 unless stated otherwise.