Puma Heritage Estate Planning Service

Open for investment

0%

capital losses to date

£2bn+

value of funded developments1

Plan for the future

Puma Heritage Estate Planning Service is an investment solution that aims to provide you with 100% relief from inheritance tax after two years1.

The Service invests in private trading companies - such as Puma Heritage Ltd - that seek to qualify for Business Relief whilst delivering stable and attractive return.

We are very proud of our track record, having delivered consistent returns while incurring no capital losses to date.

Limited time offer: 0% initial dealing fee

Puma is offering a 0% initial dealing fee on the next 200 applications or by 19 December 2024, whichever is sooner.

This offer applies to valid applications received on or between 1 October and 19 December 2024. Please note that the offer applies solely to the initial dealing fee. The Puma Heritage Estate Planning Service (EPS) continues to charge investors an initial fee of 1.5% of the application amount and a 1% dealing fee on the sale of shares in portfolio companies. For complete information regarding fees and expenses, including details of the Annual Ongoing Fee and the portfolio company running costs, please refer to the Puma Heritage EPS Investment Overview available here.

Six key reasons

Investing for long-term tax planning is important. Scroll through the reasons to recommend the Service, so together we can help you to manage your estate tax efficiently.

Quarterly Report

Read our latest quarterly report where you will find an update on the performance, along with recent loan highlights.

Trading highlights include:

- £104m new loans made in the quarter

- 3.3% total shareholder return for growth shares in the 12 months to 30 June 20242

- 62.5% weighted average loan to value

Performance in more detail

Consistent growth of Net Asset Value (NAV) per growth share

NAV per Growth Share

total shareholder return for growth shares in the 12 months to 30 June 20242

Values are estimates, as they have not been audited. You can also read the annual audited figures and see historical NAV data.

This shows Puma Heritage Ltd’s shareholder return net of ongoing annual fees payable to Puma Investments. It does not take account of initial or dealing fees associated with investing in the Puma Heritage EPS. The graph shows the net asset value performance of the growth shares in Puma Heritage Ltd on the same basis.

Past performance is no indication of future results, and share prices and their values can go down as well as up. Please refer to the fees further down the page. Figures correct at 30 June 2024 and may be subject to rounding errors. Source: Puma Heritage Ltd.

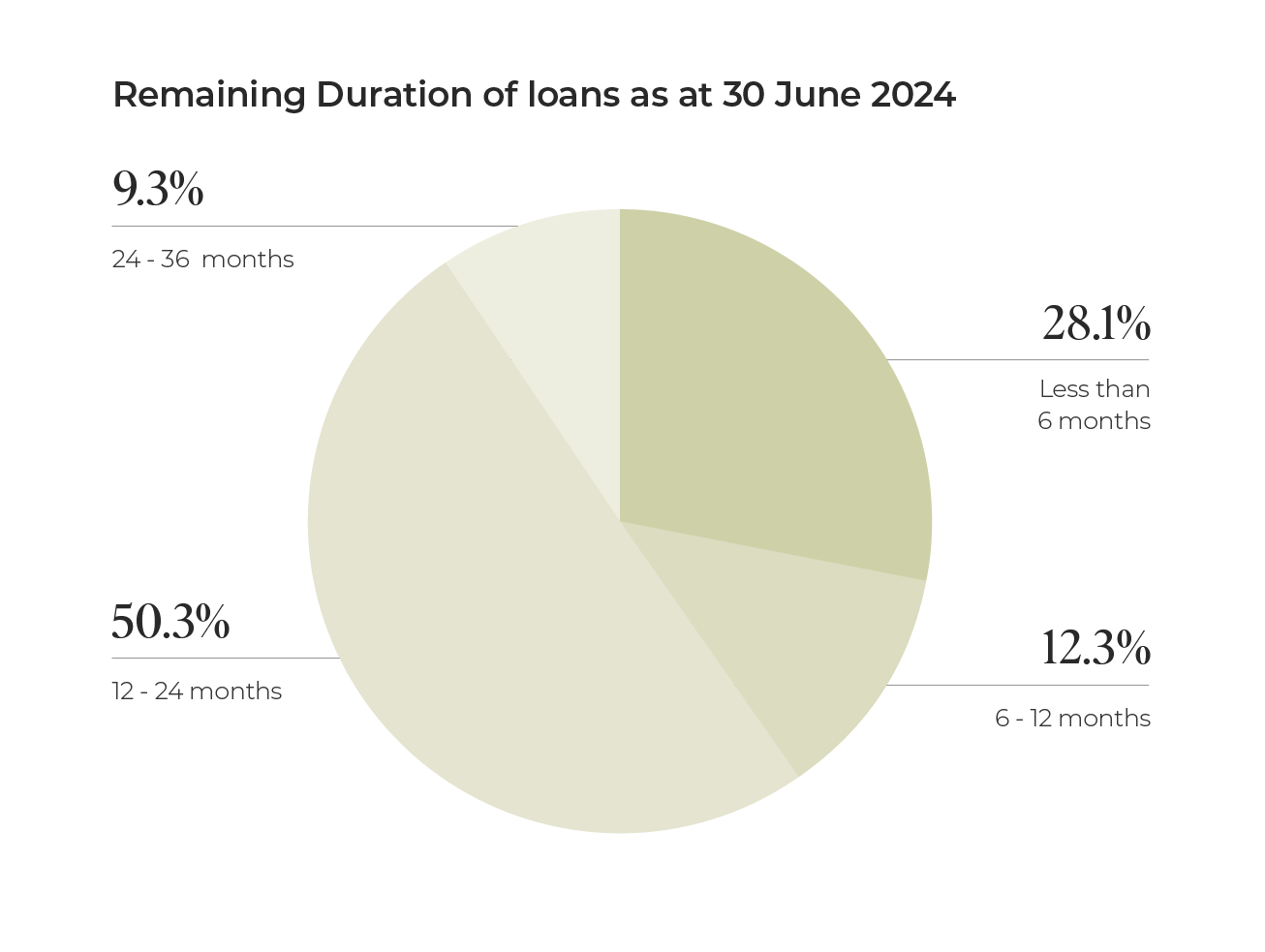

Sector breakdown of loans

One way we diversify our loan book is by providing loans to different sectors. This enables us to maintain a conservative risk profile.

% of amount deployed

- 1Care homes

- 2Student accommodation

- 3Retirement living

- 4Serviced apartments

- 5Commercial

- 6Residential

- 7Life Sciences

- 8Build-to-rent

- 9Mixed use

- 10Hotel

- 11Nursery

- 12Co-living

Explore our most recent loans

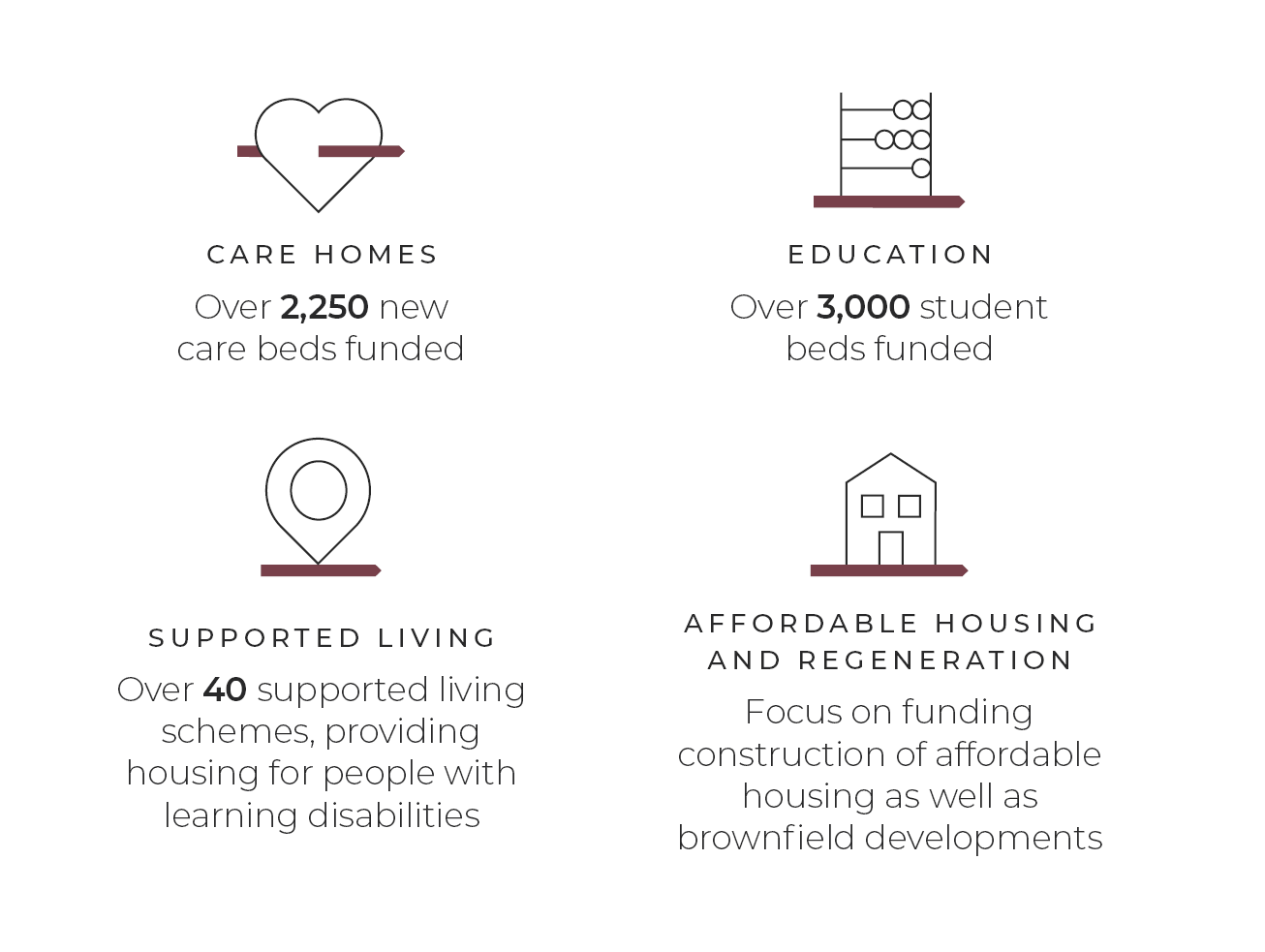

We invest in companies with a strong reputation for providing senior secured loans, underpinned by real estate. Our loans range from £10 million to £50 million.

Investing directly with us

All fees are inclusive of VAT where applicable. Please refer to the Investment Overview for full details.

PUMA INITIAL FEE

1.5%

of the application amount

PUMA DEALING FEE

1%

applied to the purchase and sale of shares in portfolio companies

ANNUAL ONGOING FEE

0.5% + VAT pa

of the Net Asset Value of each portfolio company

Puma AIM IHT Service

The Service seeks to grow your money over the long term, mitigating your inheritance tax (IHT) liability.

Find out more

Puma AIM ISA IHT Service

The Service offers a tax-efficient ISA wrapper on your investments, while aiming to grow your money over the long term.

Find out more

All Inheritance Tax Solutions

Business Relief qualifying investments are an important estate planning option, if you're looking to mitigate the impact of IHT.

See all solutions

Risk factors

An investment in the Service carries risk and may not be suitable for all investors. Investors can only invest in the Service through a financial adviser who has assessed that an investment in the Service is suitable.

Past performance: Past performance is no indication of future results and share prices and their values can go down as well as up.

Tax reliefs are not guaranteed: Tax reliefs depend on individuals’ personal circumstances and minimum holding periods, and may be subject to change.

You may lose money: An investment in smaller companies is likely to be higher risk than other investments. Investors’ capital may be at risk and investors may get back less than their original investment.

Long-term investment: An investment in the Service should be considered a long-term investment.

Potentially illiquid investment: Private trading company shares are illiquid. They are characterised by significant spreads and low trading volumes. It may prove difficult for investors to realise immediately or in full proceeds from the sale of such shares.

Life protection: Life protection for the Puma Heritage Estate Planning Service is subject to certain conditions, if these conditions are not met in full then Puma Investments will not be paid out and so no payment will be made to beneficiaries.

Figures on this page are taken from Puma Investments and are correct as of 30 June 2024 unless stated otherwise.

Sources

For all performance data: Source: Puma Heritage Ltd. Figures correct at 30 June 2024 and may be subject to rounding errors.

1 Tax reliefs are not guaranteed, depend on individuals’ personal circumstances, minimum holding periods and may be subject to change.

3 Source: Puma Heritage Ltd. Figures correct at 30 June 2024.

4 The total shareholder return is calculated using the net asset value of Puma Heritage Ltd, and is net of ongoing annual fees payable to Puma Investments. It does not take account of initial and dealing fees associated with investing in the Puma Heritage EPS.