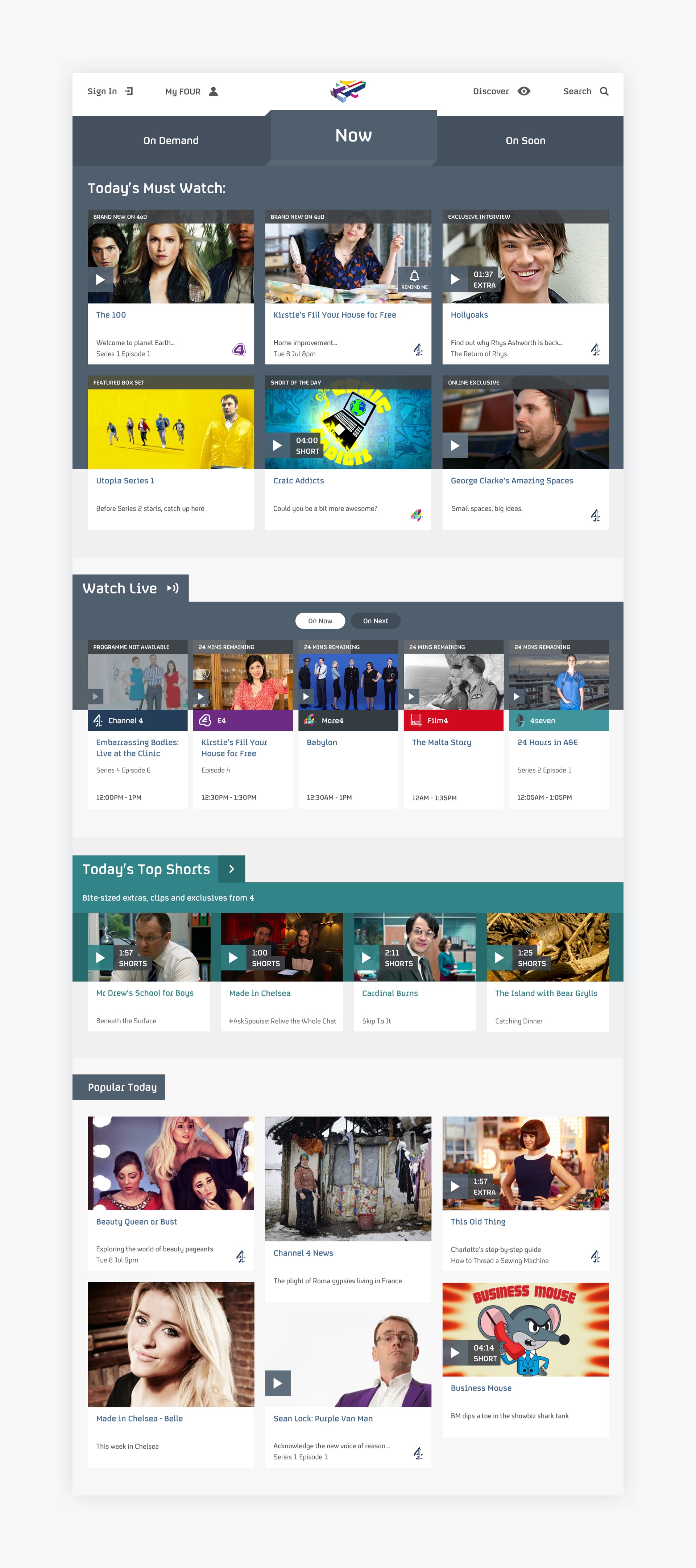

Puma Alpha EIS

Open for investment

£89m

Raised by our EIS funds

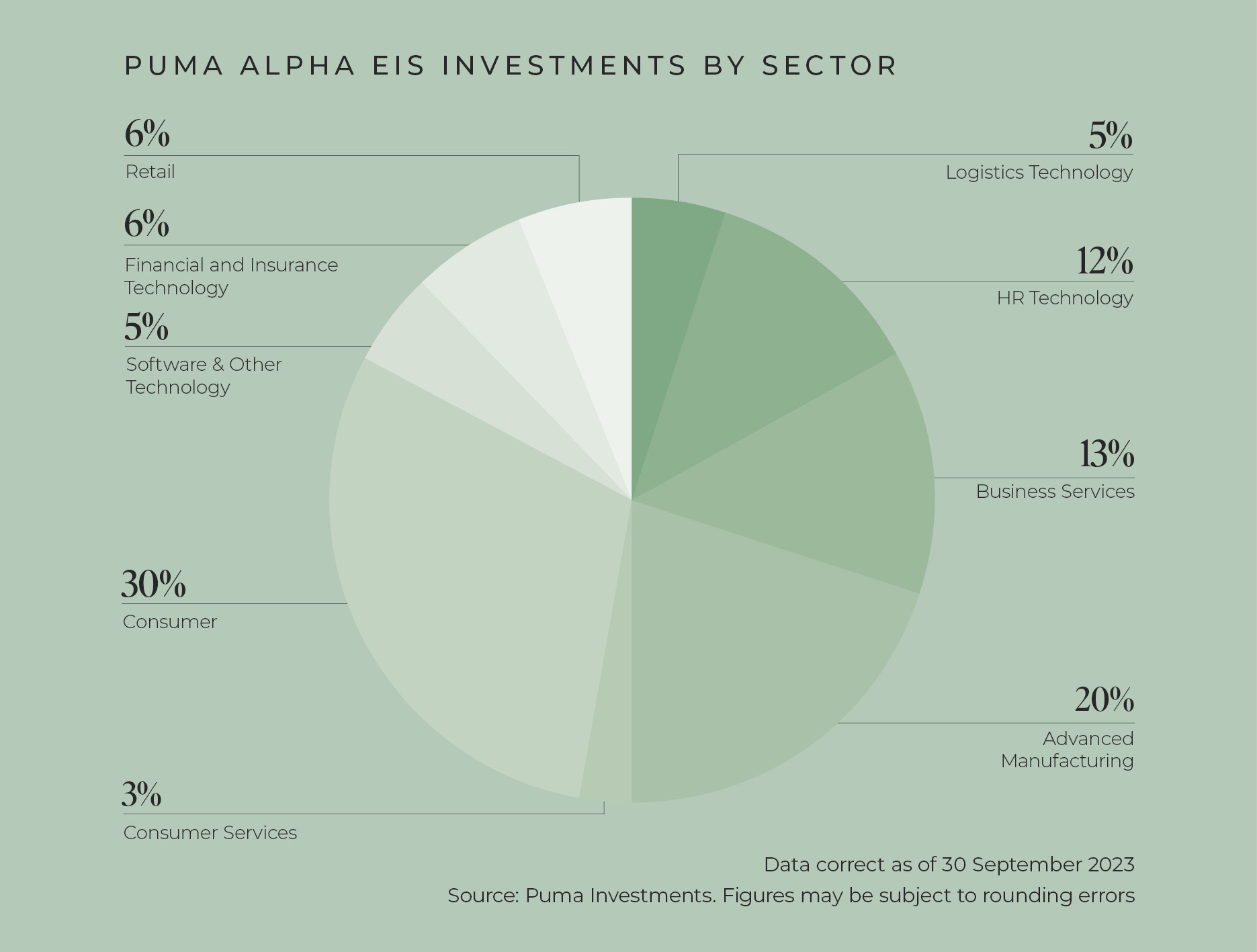

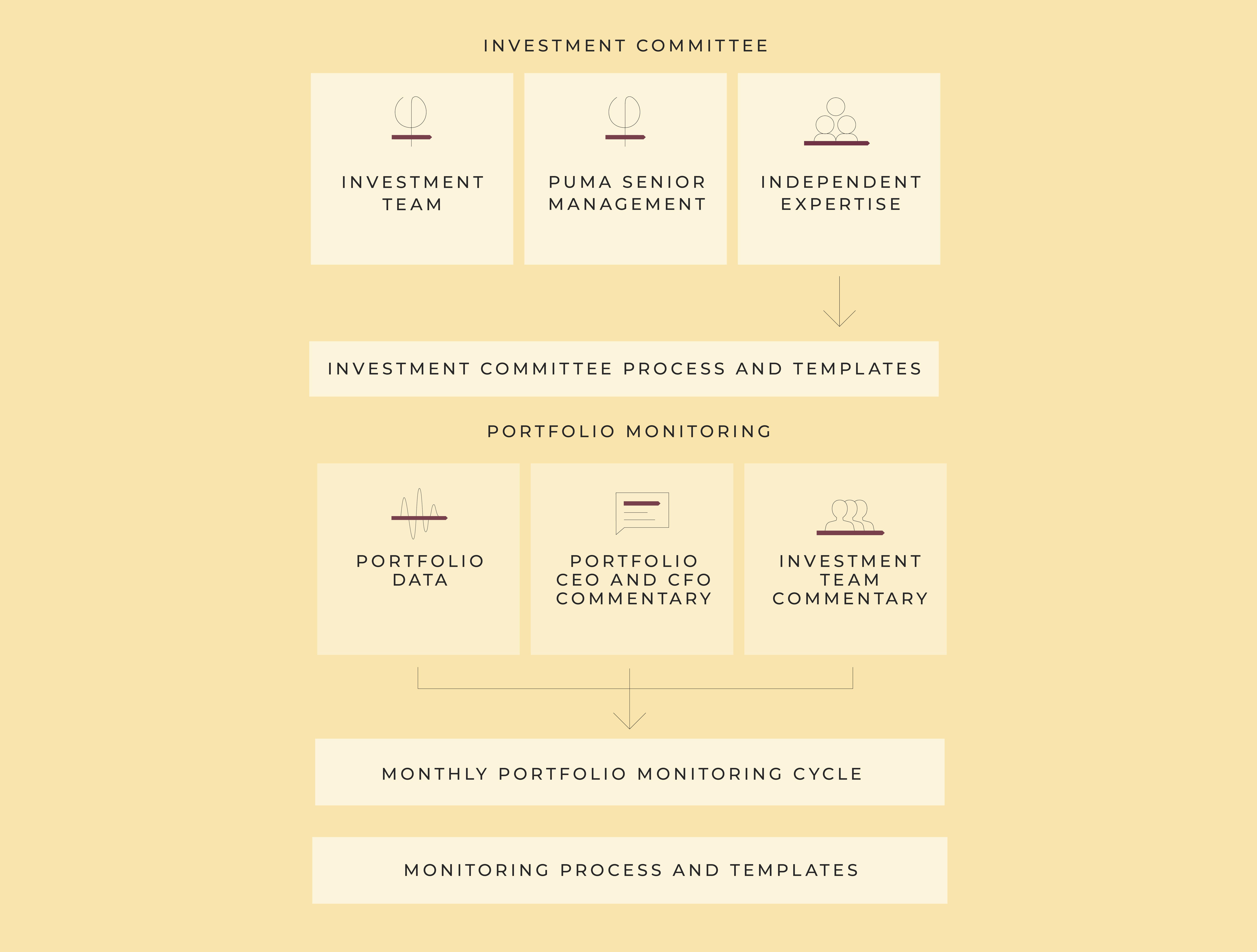

At Puma Investments, we have an 18 year track record of investing in smaller companies. In this time we have launched two EIS funds, and both EIS funds have investments across 27 SMEs currently.

Puma Alpha EIS is the second EIS fund from Puma Investments and launched in 2017. It aims to deliver compelling returns through investments in companies that have graduated from “start-up” to “scale-up”, while delivering the full range of tax reliefs that come with EIS investing.

Together the Puma VCTs, Puma EIS and Puma Alpha EIS have invested over £310 million.

We've invested into 65 qualifying companies.

We've made 38 full exits.

Six key reasons to choose Puma Alpha EIS

We believe Puma Alpha EIS offers investors six key benefits as part of their portfolio, helping them to achieve their long-term financial planning goals.

Key tax benefits of investing in the EIS

There are numerous ways in which investors can benefit from an investment into the EIS. These include:

- Income Tax Relief

- Capital Gains Tax exemption

- Capital Gains Tax deferral

- Loss Relief

- Business Investment Relief

- Inheritance Tax Exemption

Tax reliefs are not guaranteed, depend on your personal circumstances, have a three-year minimum holding period, and may be subject to change.

Fees and charges

Puma Alpha EIS offers investment in early stage businesses and attracts competitive fees and charges. These include:

INITIAL FEE

3%

of net application amount (application amount less any adviser fee)

ANNUAL MANAGEMENT FEE

2%

(plus VAT) of funds subscribed (net application amount less the Puma Initial Fee)

PERFORMANCE FEE

20%

of the difference between the Total Return1 and the amount invested in the equity capital of the portfolio companies making up the Investor's portfolio

Learn more about EIS

If you would like learn more about Enterprise Investment Schemes and how they can be used as an additional retirement planning tool, read our guide.

We look at the key benefits, tax reliefs and types of companies that you can invest in through an EIS fund. You can also learn about how to invest and the risks you should take into consideration.

Risk factors

You can only invest in Puma Alpha EIS through a Financial Adviser who has assessed that an investment is suitable for you. An investment in Puma Alpha EIS carries risk and you should read in full the Puma Alpha EIS Investment Details. Below are the key risks:

General: Past performance is no indication of future results and share prices and their values can go down as well as up. The forecasts in this document are not a reliable guide to future performance.

Liquidity: It is unlikely there will be a liquid market in the shares of the EIS-qualifying companies, and it may prove difficult for investors to realise their investment immediately or in full.

Capital at risk: An investment in Puma Alpha EIS can be viewed as high risk. Investors' capital may be at risk and investors may get back less than their original investment.

Tax reliefs: Tax reliefs are not guaranteed, depend on individuals’ personal circumstances and have a three-year minimum holding period, and may be subject to change.

Figures on this page are taken from Puma Investments and are correct as of 31 December 2023 unless stated otherwise.