Open for investment

0%

Capital losses to date

88/100

Tax Efficient Review

December 2023

Overview

Puma Heritage EPS is an investment solution that aims to provide investors with 100% relief from inheritance tax after two years. It invests your funds in private trading companies seeking stable returns. High-quality assets underpin these companies and have a conservative trading strategy.

Six reasons to choose the Puma Heritage EPS

We believe that the following six features make Puma Heritage EPS a compelling investment for investors looking to manage their estate tax efficiently.

Track record

Puma Investments, together with its subsidiary, Puma Property Finance Limited, has been involved in secured lending for over 15 years.

As Investment Manager to the Service, Puma Investments advises the Service’s portfolio companies, helping these companies to identify, due diligence, execute, and monitor high-quality transactions.

The Service’s portfolio companies benefit from the multi-disciplinary in-house expertise at Puma Investments, which comprises experienced underwriters, legal, finance, and risk professionals. The Puma Heritage Estate Planning Service invests in private trading companies, including Puma Heritage Ltd, that have a conservative trading strategy focused on secured lending.

Consistent growth of Net Asset Value (NAV) per share

Key Stats

£109.3m

new loans made in the quarter

3.3%

total shareholder return for growth shares in the 12 months to 31 December 2023

62.4%

weighted average LTV

The performance data in the Key Stats above show Puma Heritage Limited’s shareholder return net of ongoing annual fees payable to Puma Investments. It does not take into account the initial or dealing fees associated with investing in the Puma Heritage Estate Planning Service. The graph above shows the net asset value performance of the growth shares in Puma Heritage Ltd on the same basis.

Note: Past performance is no indication of future results and share prices and their values can go down as well as up. Figures correct at 31 December 2023 and may be subject to rounding errors. Source: Puma Heritage Ltd.

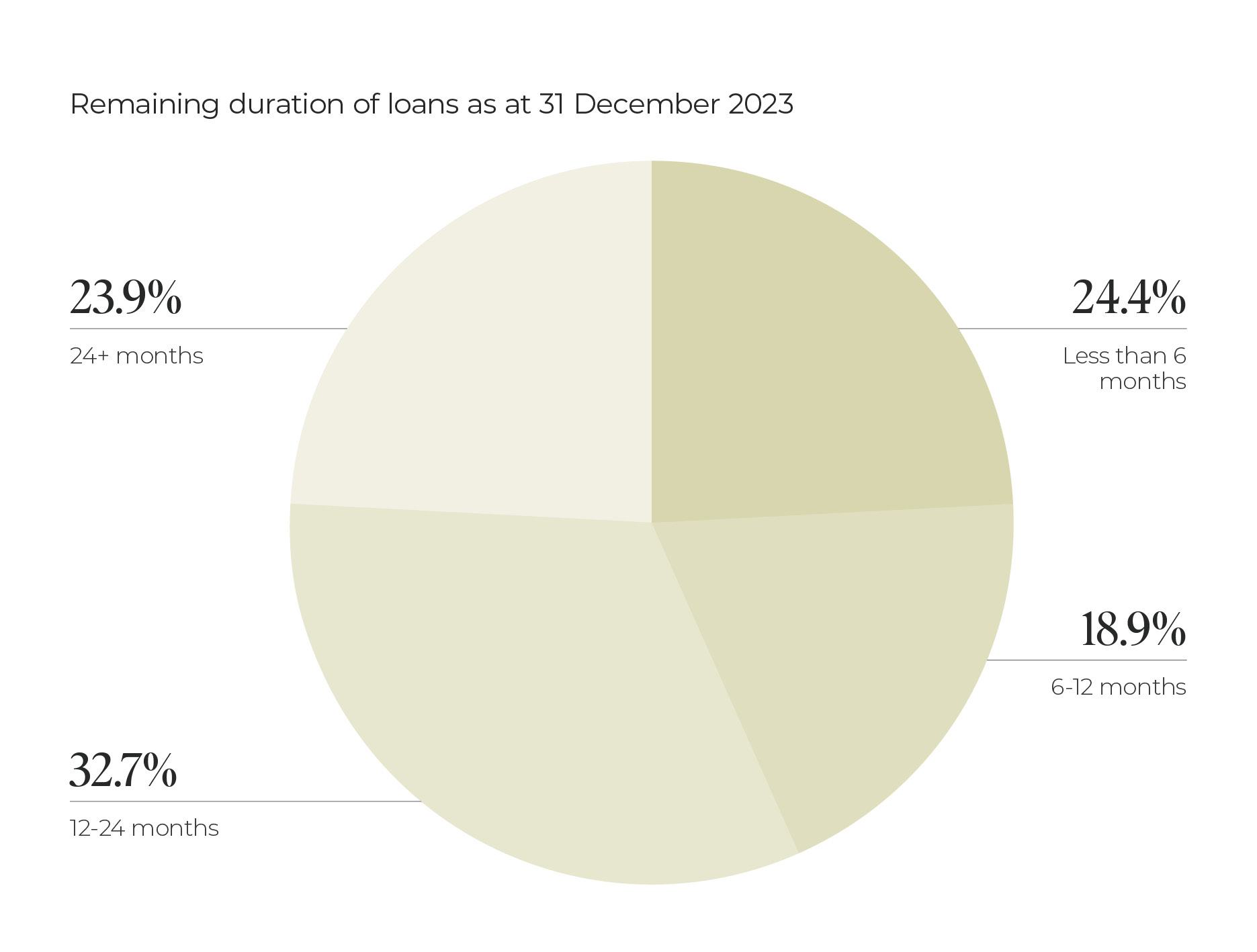

Sector breakdown of loans

% of amount deployed as at 30 September 2023.

Source: Puma Heritage Ltd. Past performance is no indication of future results, and share prices and their values can go down as well as up. Figures may be subject to rounding errors.

Independent expert oversight

Portfolio companies benefit from an independent Board comprising highly experienced senior independent directors, panels of expert professional advisers, and independently audited.

Michael Posen

Chairman, Puma Heritage Ltd

Graeme Alfille-Cook

Director, Puma Heritage Ltd

Michael van Messel

Director, Puma Heritage Ltd

Fees and charges

PUMA INITIAL FEE

1.5%

of the application amount

PUMA DEALING FEE

1%

applied to the purchase and sale of shares in portfolio companies

DEFERRED ANNUAL ONGOING FEE

1% + VAT pa

deferred and only paid in full by each portfolio company if the company achieves a minimum return of 3% pa

Risk factors

An investment in the Service carries risk and may not be suitable for all investors. Investors can only invest in the Service through a financial adviser who has assessed that an investment in the Service is suitable.

Past performance: Past performance is no indication of future results and share prices and their values can go down as well as up.

Tax reliefs are not guaranteed: Tax reliefs depend on individuals’ personal circumstances and minimum holding periods, and may be subject to change.

You may lose money: An investment in smaller companies is likely to be higher risk than other investments. Investors’ capital may be at risk and investors may get back less than their original investment.

Long-term investment: An investment in the Service should be considered a long-term investment.

Potentially illiquid investment: Private trading company shares are illiquid. They are characterised by significant spreads and low trading volumes. It may prove difficult for investors to realise immediately or in full proceeds from the sale of such shares.

Life protection: Life protection for the Puma Heritage Estate Planning Service is subject to certain conditions, if these conditions are not met in full then Puma Investments will not be paid out and so no payment will be made to beneficiaries.

Figures on this page are taken from Puma Investments and are correct as of 31 December 2023 unless stated otherwise.